However, the latest probe comes on the back of another investigation into the LuxLeaks affair, which exposed "sweetheart" deals given by Luxembourg — allowing hundreds of companies to use taxation devices to reduce their tax liabilities in other member states.

#PanamaPapers inquiry committee hears from journalists who reported on them. Live → https://t.co/kPepbT9HSS pic.twitter.com/0CrtdQ0MCR

— European Parliament (@Europarl_EN) 27 September 2016

Despite taking evidence for several months, the LuxLeaks investigation has, so far, failed to put an end to the schemes. The original investigation — known as TAXE 1 — criticized some member states for not cooperating with their inquiry and called on the European Commission to take action to stamp out such tax avoidance schemes.

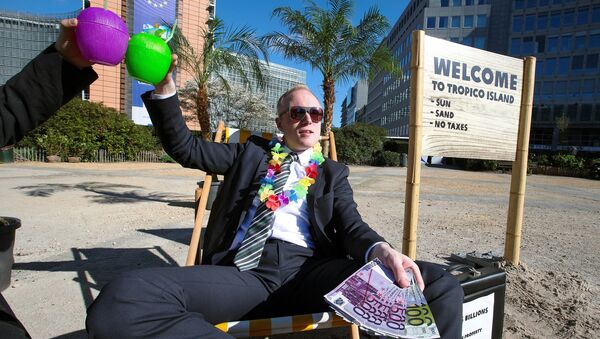

Following the sheer scale of tax avoidance exposed by LuxLeaks and the Panama Papers, lawmakers called for a clampdown on companies with offshore profits and assets, in order to reduce their tax liabilities in EU member states.

The room is full during the #PanamaPapers #PANA hearing of @ICIJorg. @DariuszRosati will ask the first @EPP question. #tax #BahamasLeaks pic.twitter.com/C6LKcrYLNc

— Pawel D. Wisniewski (@paweldariusz) 27 September 2016

However, the latest move by the Commission — headed up by former Luxembourg finance minister and prime minister Jean-Claude Juncker — has angered politicians. It has released a list of "third countries" which will be investigated to identify which are tax havens. However, the list does not include Ireland or Luxembourg, both of which are embroiled in battles with Brussels over sweetheart tax deals.

Inquiry committee investigating the #PanamaPapers holds press conference

— Mohammed Asbahi (@asbahi_mohammed) 27 September 2016

LIVE NOW: https://t.co/JR1EhzgRBM pic.twitter.com/735gh6wppU

Sweetheart Deals

Although the latest investigation by the European Parliament into the Panama Papers has been broadly welcomed by politicians in Europe, it remains unclear what powers they have to prevent multinationals from carrying out legitimate work to reduce their tax liabilities.

In August, the European Commission decided that Ireland granted undue tax benefits of up to US$14.6 billion to Apple. This is illegal under EU state aid rules, because it allowed Apple to pay substantially less tax than other businesses. It has ordered Ireland to recover the illegal aid. Both Apple and Ireland are appealing the ruling. Both Apple and the Irish Government are appealing the ruling.

The landmark ruling followed months of investigations into so-called "sweetheart deals" offered by countries such as Ireland, the Netherlands and Luxembourg which offer benign tax regimes that allow companies — particularly multinationals such as Apple, Amazon, Starbucks and Fiat Finance and Trade — to enjoy special tax arrangements to reduce their tax obligations in other countries.

Another major issue is that Britain — which is about to negotiate itself out of the EU — is at the center of a major network of tax havens, such as the British Virgin Islands, Jersey, Guernsey, the Isle of Man and the Cayman Islands. Whatever the outcome of the Panama Papers probe, it is unlikely that the EU will be capable of acting on aggressive tax schemes in non-EU member states, which Britain could well be in a few year's time.