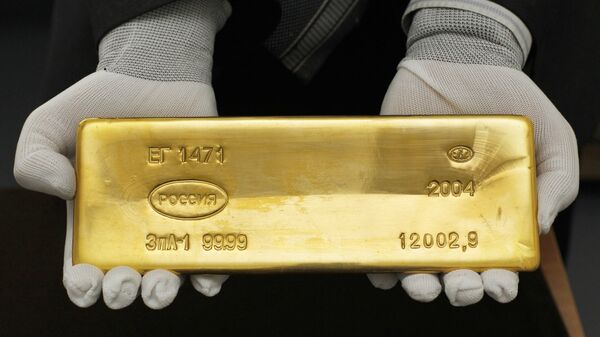

According to Philip Klinkmüller, a financial expert with Hopf-Klinkmüller Capital Management, there is a visible trend in Russia and China to buy more bullion to end their dependency on the US dollar.

The expert suggested that in the years to come global financial markets will see a significant devaluation of the American currency.

"According to our estimates, there will be a downward trend in the dollar exchange rate in the next 15 years. In the long-run, it cannot be guaranteed that the dollar will remain a global reserve currency," Klinkmüller told Sputnik Germany.

Bullion was traditionally a major part of the Russia’s and China’s gold and foreign exchange reserves. At the same time, nearly 60 percent of global exchange reserves are denominated in dollars.

On the one hand, gold is a national reserve in the event of a crisis. On the other hand, gold reserves help compensate losses from a fluctuating dollar.

By stockpiling bullion, Russia and China want to get more independent in trading gold and cut their reliance on the US dollar, according to Jochen Stanzl, a market analyst at CMC Markets.

"If the country buys only one currency it gets highly dependent on its exchange rate. By purchasing gold, the central bank diversifies its resources and enhances the soundness of nation’s assets," Stanzl said.

In turn, Klinkmüller noted that buying gold is "absolutely reasonable" for Russia since the yellow metal is helpful to offset the negative effect from sanctions.

"Russia wants to be more independent from the US dollar and act at global financial markets, using gold as a payment instrument. One of the reasons is sanctions imposed by the United States and the European Union over the Ukrainian crisis, including those in trade and investment," the financial expert explained.

The expert outlined the two most probable reasons behind Beijing’s rush on the global bullion market.

"First, China wants to use gold reserves to boost its national currency [the renminbi] which was added to the International Monetary Fund’s basket of reserve currencies last year. Moreover, China has a large foreign trade deficit with the US. By stockpiling bullion, Beijing wants to decrease its dependency on the US," Stanzl said.

At the same time, both experts underscored that gold purchases by Russia and China are not contributing to driving up gold prices in the global market.

According to the World Gold Council, China and Russia are ranked sixth and seventh on the list of country with the largest gold reserves, with 1,843 tons and 1,655 tons respectively. The first on the ranking is the US with 8,134 tons. It is followed by Germany (3,380 tons) and the IMF (2,814 tons).