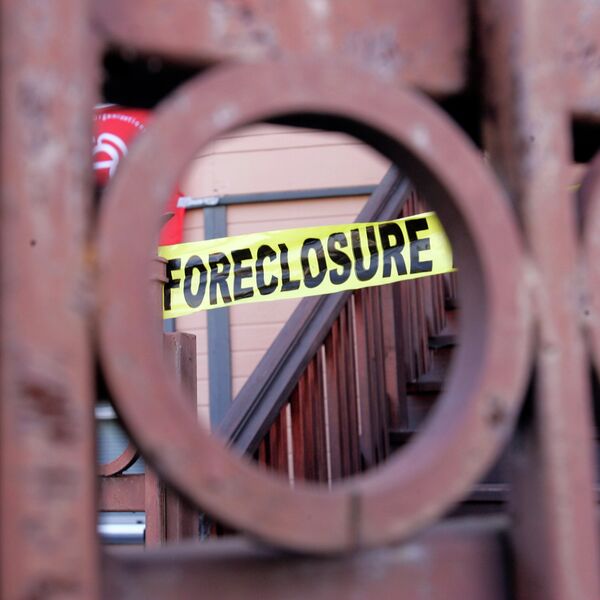

U.S. home foreclosures have been on the rise for the past two months. Over 60,000 homes were set to be auctioned off in October alone. That is a 24% increase from the previous month and a 7% rise from last year, according to housing data firm RealtyTrac. Over 700,000 homes were foreclosed on last year. That amounts to the highest spike since May 2013. The housing crisis, it seems, continues.

So why is this happening? Continued abusive foreclosure procedures, a growing backlog of foreclosed mortgages, and a demand for cheap housing from institutional investors seem to be the main reasons behind the rise.

“While the overall market is moving full steam ahead, our newest concern is in the increasing number of reported deeds in lieu of foreclosure and sheriff sale transactions adding to the REO inventory held by lenders,” Michael Mahon, executive vice president and broker at HER Realtors in Ohio told RealtyTrac. “Much of this increase in foreclosure activity is attributed to the lack of incentive for mortgage servicers and consumers to attempt mutually beneficial foreclosure alternatives. Many servicers are acting in a much quicker manner when dealing with mortgage default situations in an attempt to minimize costs of maintaining distressed assets, as well as taking advantage of appreciating home values across Ohio.”

Since the housing bubble burst, banks have been trying to avoid flooding the market with foreclosed properties. At the same time they’re trying to clear a backlog of delayed foreclosures. Meanwhile institutional investors are looking for cheap real estate. They’re chomping at the bit to buy houses, sight unseen, eager to turn them around and put them on the rental market.

Abusive foreclosure procedure is a key problem in the rotten cycle between mortgage servicing companies and banks.

These companies have traded mortgages so many times that the original documentation is lost in the endless cycle of sales and resales.

In 2010 major US mortgage lenders like J.P. Morgan Chase, Ally Financial and Bank of America suspended foreclosures across the country over the practice of robo-signing. A robo-signer is an employee of a mortgage servicing company that creates false or forged legal documents relating to mortgage foreclosures, or signs such documents, without knowledge of the facts or details to which the documents attest. They were typically the middle managers or low-level personnel of the mortgage servicing company.

So robo-signing is out. Enter robo-witnessing. Servicers then trained temporary or low-level employees to testify in court that the details of the robo-signed documents were legitimate. Flown from one state to the next, these supposed witnesses had no detailed knowledge of the foreclosures they were asked to testify about. This practice failed as well, although servicers continue using improper techniques when foreclosing. And robo-signing and robo-witnessing, are by no means the only alleged fraudulent actions. Issues with property tax payments are usually tied to corrupt practices of the mortgage industry. Additional fees, which were not stated in the original mortgage contract, quickly pile up before and after foreclosure. Late fees are hard to argue with, when the servicers have their documentation forged to a particular case. In ninety-five percent of cases borrowers never show up to defend their foreclosures.

While the servicers try to find shortcuts to untangle their messy foreclosure documentation, they are covering for banks and their reckless lending practices that inflated the housing bubble. Back in 2012, when banks paid a $26 billion settlement, they pretty much got off the hook. As they took their sigh of relief, borrowers were left to really pay for their mistakes.

The bottom line is that the dirty deeds of the mortgage servicing companies have not really been thoroughly cleaned up. Banks hide behind servicers, and not a single top executive has been prosecuted for the fraudulent practices that left Americans jobless and homeless, as the global financial crisis grew. So why should they change their ways?