Getting to this point has been a perpetually fraught and bruising process. At various points, it seemed as if the country — if not the eurozone, or indeed the European Union itself — was on the verge of total collapse.

It was a period that saw four separate governments implode — and almost implode — as they struggled to stave off bankruptcy, and relied on US$296 billion (260 billion euros) borrowed from the European Union and International Monetary Fund to stay afloat, the biggest bailout in history.

Athens emerges from the decade of hurt with its economy recovering, unemployment down to 19.5 percent, and potentially bright days ahead — although its public debts remain the highest in the eurozone, at 180 percent of national output.

January 2001 — Greece Joins Euro

In 1999, the euro was launched as an accounting currency — physical notes and coins would finally circulate three years later — in 11 EU member states. However, Greece was not among them, as the country didn't meet the fiscal criteria for membership — inflation below 1.5 percent, budget deficit below three percent, and a debt-to-GDP ratio below 60 percent.

August 2004 — Athens Hosts Olympic Games

The 2004 Olympics were intended to be a powerful statement of both past and future — an honorific bow to history (the first modern Olympics was held in Athens in 1896), and a glance ahead to modern Greece, a key hub of culture, tourism and more in an increasingly united Europe.

February 2007 — Financial Crisis Erupts

The US sub-prime mortgage market collapses, following 2006's housing bubble bursting, triggering a global banking crisis and credit crunch that lasts through 2009, prompting government bailouts of banks in the United States and Europe. As borrowing costs rise and financing dries up, Greece is unable to service its ever-escalating debts.

October — December 2009

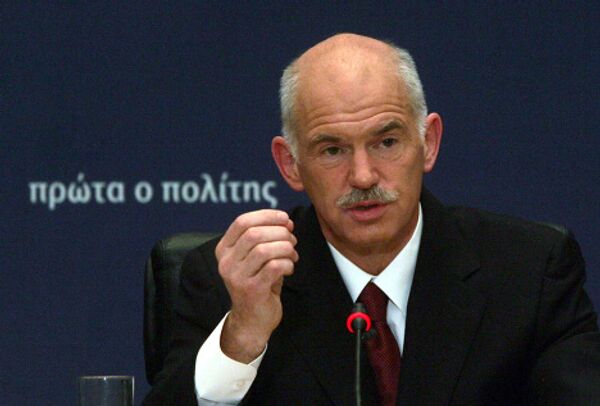

The final quarter of 2009 sees Greece's financial crisis explode in earnest. In October, George Papandreou, leader of the Greek socialist party, wins national elections and becomes prime minister. Within weeks, he shocks the world by revealing Greek accounts are blighted by a hitherto unacknowledged black hole — the country's deficit is actually almost double the previous administration's estimates, and will hit 12 percent in the near future.

May 2010 — First Bailout Package Agreed, Athens in Flames

With Greece teetering perilously on the brink of bankruptcy, the government officially requests and receives a bailout package from the International Monetary Fund and EU. The country is scheduled to receive US$146 billion (110 billion euros) in loans over three years, with Berlin stumping up just over a quarter of the EU's total contribution — a move that will prove increasingly controversial in Germany in the years ahead. EU finance ministers admit the vast sum is likely to be the first instalment of many.

Prime Minister Papandreou pledges austerity measures, including US$34.2 billion in spending cuts and tax increases — but enacting the policy is a fraught process, with several parliamentary debates that threaten to turn physically violent, and thousands taking to the streets of Athens and other major cities in protest, engaging in fiery clashes with police along the way. In the end, 172 MPs vote in favor of the measures — although Papandreou is compelled to expel a trio of deputies from his ruling coalition for abstaining.

October — November 2011 — Papandreou Proposes Referendum

With citizens' finances worsening and public anger growing each and every day, Papandreou proposes a national referendum on a second bailout agreement then-under negotiation, but within days calls it off after opposition parties agree to back the new deal. However, it soon becomes clear he cannot command authority in parliament, so resigns. A new coalition is formed, headed by former European Central Bank Vice President Lucas Papademos.

January 2012 — VIP Evaders Outed

The Greek government publicly names and shames — and prosecutes — 4,000 of the country's biggest tax evaders, who owe a collective US$17.1 billion to the exchequer. Among them are renowned singer Tolis Voskopoulos and basketball player Michael Misounof. The government had to change privacy laws to publish the details.

EU finance ministers approve a second bailout for Greece in conjunction with the IMF, worth around US$172 billion, and including a 53.5 percent debt ‘haircut' for private Greek bondholders. In return for the funds, Greece is obliged to reduce its debt-to-GDP ratio from 160 percent to 120.5 percent by 2020. The debt restructuring, the largest ever in history, is completed March 9.

April 2012 — Pensioner Commits Suicide Outside Parliament

A financially ruined 77-year-old retired Greek chemist shoots himself dead outside parliament in Athens, leaving a note saying he refused to scrounge for food in the rubbish, or leave his debts to his progeny. A makeshift shrine is created in short order by similarly ailing citizens, who leave notes of their own — one says "enough is enough".

May — June 2012 — An Electoral Revolution

In the general election, voters reject established candidates, a majority backing fringe parties opposed to the EU-IMF bailout program and austerity policies. However, the collapse of the Socialists allows New Democracy's Antonis Samaras to form a coalition — and he makes clear Greece will remain committed to existing plans.

August 2012 — Greek Unemployment Hits Record Levels

Greece's jobless rate rises for a 39th consecutive month to a new record of 25.4 percent, well over double the eurozone average of 11.5 percent. Worst hit are 15-24 year old Greeks, with 58 percent out of work — it was a comparatively trifling 20 percent a mere four years earlier.

July 2013 — Yet More Austerity

Parliament approves new austerity measures, imposed on the country by the bailout terms — the raft of highly controversial and deeply unpopular policies mean, among other things, the layoff of around 25,000 public sector workers, tax rises, budget cuts and wage reductions. Rioting across the country reaches a crescendo, and unions hold a general strike in protest — but the move unlocks a new bailout tranche worth US$9 billion.

April 2014 — Greece Rejoins International Financial Markets

A day before German Chancellor Angela Merkel visits Athens, Greece returns to international financial markets, issuing its first Eurobonds in four years — a cause for celebration marred by a car bomb exploding outside the Greek central bank in the morning. One of Greece's most militant guerrilla groups, Revolutionary Struggle, claims responsibility.

The launch is nonetheless a success, with the government raising more than a billion euros than originally expected. Meanwhile, average Greek incomes have fallen by a third in four years.

January 25 2015 — Syriza Win Big

Samaras calls a snap election — and is rewarded by his ouster from office, with newly-formed anti-austerity party Syriza securing a resounding victory, shattering over four decades of two-party rule in the country. New Prime Minister Alexis Tsipras says he'll ensure a renegotiation of bailout terms, debt cancellation and renewed public sector spending — pledges guaranteeing a bitter confrontation with the IMF and EU in the months ahead.

June 2015 — Bailout Expires

Days after negotiations between Syriza and its creditors fall apart, Athens misses a US$1.7 billion repayment, the first developed country to ever default on its obligations to the IMF. Fearing capital flight, Syriza implements emergency capital controls, limiting ATM withdrawals to 60 euros (US$67) per person per day.

July 2015 — Syriza Blinks

Tsipras' government submits to economic gravity and moves to secure parliamentary approval of yet further austerity measures in order to prevent a Greek exit from the euro, and start negotiations for yet another new bailout program, worth up to US$94 billion — despite Greeks voting overwhelmingly against the package's terms in a referendum. The move nonetheless damages Syriza, leading to resignations of key figures, including popular Finance Minister Yanis Varoufakis.

August 2015 — Third Bailout Approved

Tsipras quits and calls a new election — and Syriza yet again wins by a landslide, forming a new coalition. Parliament adopts yet another bundle of economic ‘reforms', which include further tax rises, reduction of workers' rights, budget cuts and the privatization of many state-owned assets.

February 2017 — Creditors Bicker

Tensions emerge between the EU and IMF over the third bailout package — the latter warns Greek debt levels remain unsustainable, and the austerity policies imposed by Brussels will prevent the country from growing, and repaying its obligations on time. EU representatives eventually agree to less strict budget targets, but draw the line at debt relief.

July 2018 — End in Sight?

Following the "successful" conclusion of the European Stability Mechanism stability support programme, the European Commission activates the ‘enhanced surveillance framework' for Greece, meaning the country will be subject to Brussels' watchful eye until its debt is reduced to 75 percent of GDP.

Meanwhile, newly-released figures indicate the Greek economy grew for a fifth straight quarter in January-to-March, with analysts suggesting the economy will grow by 2.3 percent in 2018 overall. Nonetheless, the International Monetary Fund says external and domestic risks "are tilted to the downside", suggesting they are skeptical of an enduring recovery ahead.