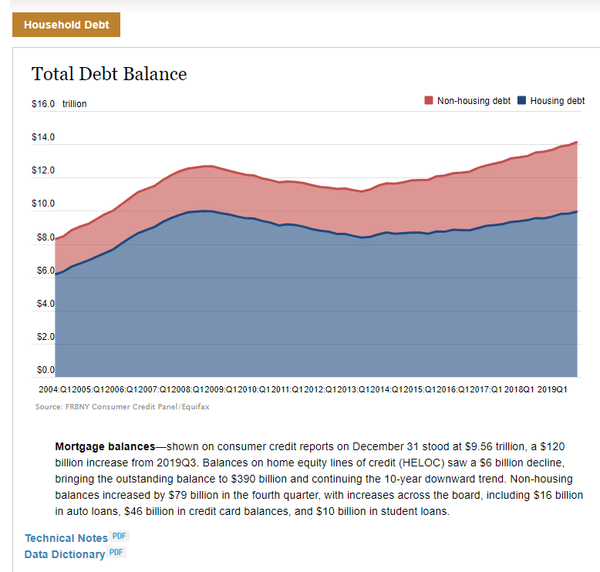

US household debt has topped $14 trillion - its highest mark ever recorded - driven steadily higher for 22 consecutive months by expanding mortgage debt, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data’s Quarterly Report on Household Debt and Credit. This is $1.5 trillion higher than its previous peak of $12.68 trillion in the third quarter of 2008, immediately before the stock market crash that preceded the Great Recession.

“Mortgage originations, including refinances, increased significantly in the final quarter of 2019, with auto loan originations also remaining at the brisk pace seen throughout the year,” Wilbert Van Der Klaauw, senior vice president at the New York Fed, said in a Tuesday news release. “The data also show that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers.”

According to the report, mortgage balances, which form the largest portion of US household debt, rose by $120 billion in the fourth quarter of 2019, reaching $9.56 trillion. Other forms of debt rose by a collective $79 billion, including $16 billion in auto loans, $46 billion in credit card balances, and $10 billion in student loans.

However, fewer credit card debtors went delinquent last quarter than the previous period, the report notes, although the number still hit an 18-month high.

“When the economy is strong you would typically not expect that unless they are changing the lending standards,” Van Der Klaauw told Reuters on Tuesday. “It could also be that the economy is very strong overall, but there are some subgroups, and maybe young people in particular, who are not benefiting as much from that.”

American consumer credit reporting agency TransUnion estimated in December that in 2020 that the number of Americans falling behind on their credit card payments would reach its highest levels in a decade. Matt Komos, TransUnion’s vice president of research and consulting, told Bloomberg at the time that with credit continuing to expand, the trend was not in itself worrisome.

Student loan debt increased by $10 billion in the fourth quarter of last year, with 11.1% of aggregate student debt more than 90 days delinquent or in default. The report also noted that the number of credit inquiries in the last six months, which indicates consumer credit demand, was 137 million in the fourth quarter of 2019.

The issue of burgeoning student loan debt in the US, which totals some $1.7 trillion, has become a hot-button issue in the 2020 US presidential campaign race, with two candidates, Senators Bernie Sanders (I-VT) and Elizabeth Warren (D-MA), both pledging to wipe out the majority of that debt. In addition, activists like the Debt Collective, which formed during the 2011 Occupy Wall Street protests, are organizing a national debt strike, in which people would refuse en masse to pay their student loan debts.

“I have to either pay my rent and get health care, or pay down my loans,” Sandy Nurse, an activist with Debt Collective, told CNBC for a Wednesday article. “It’s one of the reasons I don’t even think about having children. How can anyone afford it?”

A recent survey by consumer financial services company Bankrate revealed that just 41% of American adults could pay a $1,000 emergency expense without borrowing at least some of the money needed to pay it, Sputnik reported. Bankrate Chief Financial Analyst Greg McBride noted that the average sudden expense of $3,500, if paid for with credit, the most common method used, would incur another $1,000 in interest in other expenses.