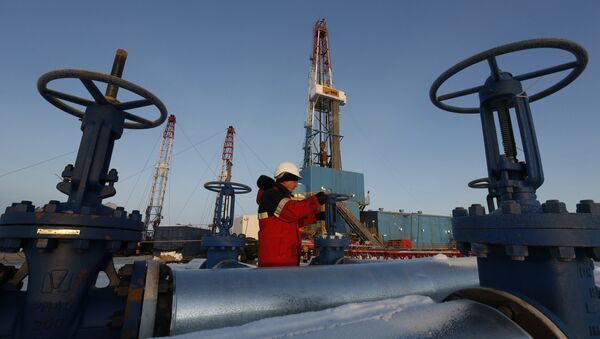

Falling oil incomes and the weakening ruble has put significant pressure on the Russian economy. As a result, Russia has insisted on talks with Saudi Arabia to cap oil output at all time highs, in a bid to stabilize the prices.

"If oil prices were Moscow’s top foreign policy priority, the oil-price theory of Russian foreign policy would predict simultaneous efforts to destabilize the region, thereby creating new risks to oil production and putting upward pressure on prices. This is not happening," Sanders wrote.

On the contrary, Moscow has been working with Riyadh to contain oil prices.

Furthermore, Russia announced the withdrawal of its forces from Syria, having shifted focus on political settlement in the region.

According to the article, if Russia planned to raise oil prices by destabilizing the Middle East it would act in a different way.

"If higher oil prices were Russia’s principal goal in dealing with Iran – why facilitate the agreement?" the author wrote.

Russia could have blocked the agreement or have agreed on Western proposals to tighten sanctions on Iran’s energy sector. Moreover, Moscow could have delayed the talks.

But President Vladimir Putin decided to support an agreement that would only further decrease oil prices, the author underscored.

"While oil prices are important for Russia, they are generally not a driving factor of Russian leaders’ key decisions," the article read.

According to Sanders, Russia does seek to influence oil prices, but only with regular diplomatic tools. The most important reason for this is that Russia sees "critical national-security interests" in the Middle East that override its concerns over oil prices. As a result, President Putin’s strategy in the Middle East has intended to produce stability.

"So Russia’s supposed secret plans to boost oil prices may produce entertaining conversation, but they don’t lead to much else," the analyst concluded.