Russian stocks surged on Friday following yesterday’s announcement that the U.S. Federal Reserve System is launching a third round of quantitative easing to encourage economic growth.

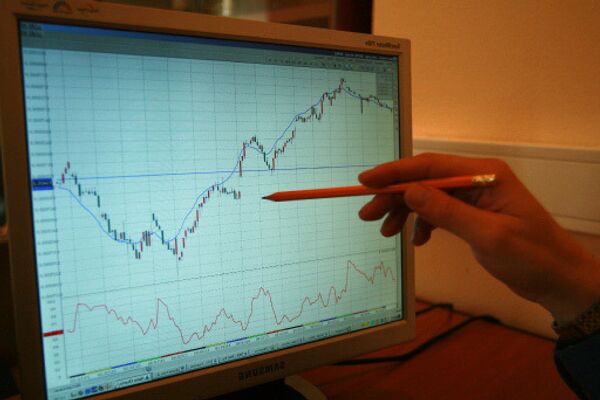

Russia’s MICEX index was up 2.90% to 1,515.33 points at 12:43 p.m. and the RTS index was up 4.50% to 1,551.68.

On Thursday the Federal Reserve announced it would purchase $40 billion in mortgage securities monthly for an open-ended period.

The move, together with the ongoing “Operation Twist” to extend the maturities of Federal Reserve assets, means the Fed will be buying $85 billion in securities each month at least until the end of the year.

The U.S. dollar lost 40 kopecks against the ruble on Friday, dropping below 31 rubles/$1.

The gains will help reverse an outflow of capital from Russian funds last week that was the second highest this year.

Earlier on Friday, Uralsib Capital reported that the net outflow from Russia-focused funds increased to $177.5 million in the week of September 6-12, citing data from Emerging Portfolio Fund Research (EPFR).

The outflow from Russian funds in the preceding week was $50.6 million.

The latest outflow was the second largest weekly total this year and compares to inflows recorded by funds focused on the other members of the BRIC group: China ($239 million), Brazil ($214 million) and India ($18 million).

But Uralsib Capital said the outflow would be temporary, since a new round of quantitative easing in the United States will likely lead to higher commodity prices, boosting Russian equities. Moreover, the flow of investment into Russian assets will strengthen as the European Central Bank moves to shore up the macroeconomic situation in the EU, the analysts said.