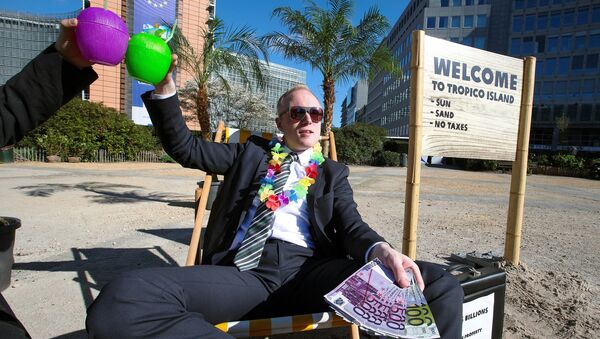

The European Union has lifted eight countries, among which are South Korea and Panama, from its blacklist after they vowed to deal with the bloc's concerns about offering tax havens for wealthy individuals and corporations, AFP reported.

The United Arab Emirates, Tunisia, Mongolia, Macau, Grenada and Barbados were also removed from the list of countries that encourage tax dodging practices.

READ MORE: EU Could 'Go After' UK Tax Haven Territories During Brexit Talks

Only nine jurisdictions currently remain on the blacklist: American Samoa, Bahrain, Guam, Marshall Islands, Namibia, Palau, Saint Lucia, Samoa and Trinidad and Tobago.

The EU calls its listing process beneficial as it "prompted countries to improve their tax systems, in line with international standards," with many countries closely cooperating with the bloc and making "firm commitments to fix problems identified in their tax systems," whereas many others "actually improved their standards immediately, in response to the EU listing exercise."

READ MORE: European Union Reportedly Blacklists 17 Tax Havens

The EU's list of non-cooperative tax jurisdictions was issued in the wake of the leak of the "Panama Papers" which included thousands of leaked files from Panama-based law firm Mossack Fonseca, which have revealed alleged illegal finance practices of officials and public figures from various countries.