https://sputnikglobe.com/20220407/rishi-sunaks-wife-appears-to-avoid-taxes-on-foreign-income-in-uk-thanks-to-non-dom-status-1094542838.html

Rishi Sunak's Wife Appears to Avoid Taxes on Foreign Income in UK Thanks to 'Non-Dom' Status

Rishi Sunak's Wife Appears to Avoid Taxes on Foreign Income in UK Thanks to 'Non-Dom' Status

Sputnik International

In recent weeks, Rishi Sunak has come under fire over various issues linked to his wife, Akshata Murthy, daughter of Infosys founder N. R. Narayan Murthy. The... 07.04.2022, Sputnik International

2022-04-07T09:04+0000

2022-04-07T09:04+0000

2023-05-28T15:18+0000

rishi sunak

britain

infosys

tax evasion

united kingdom (uk)

https://cdn1.img.sputnikglobe.com/img/07e6/03/17/1094108123_0:144:3131:1905_1920x0_80_0_0_7dacea229e4e1a079c3eb31035cbfd2e.jpg

British Chancellor of the Exchequer Rishi Sunak is facing the wrath of the opposition after it was been revealed that his multi-millionaire wife Akshata Murthy does not pay income tax on foreign earnings due to her non-domicile status.Akshata Murthy owns a 0.93% stake in the world's fastest-growing tech firm Infosys and received about $15 million as an annual dividend. UK resident taxpayers pay a 38.1% tax on dividend income. The "non-dom" status means Murthy legally does not have to pay taxes in the UK on income earned outside Britain."Akshata Murthy is a citizen of India, the country of her birth and parents' home. India does not allow its citizens to hold the citizenship of another country simultaneously", Murthy's spokeswoman said in a statement after The Independent reported that Murthy saved millions in taxes due to her non-domicile status.The statement further added that Murthy "has and will continue to pay UK taxes on all her UK income".However, there were reports in the past claiming she had routed her investment into firms based in tax haven countries that helped her to evade taxes in India. The Guardian reported in November 2020 that Murthy had channelled her money into the restaurant business in India through Mauritius-based IMMAssociates Mauritius—a 100% subsidiary of the UK-based firm International Market Management.India's Central Board of Direct Taxes (CBDT) has not shared whether it has started scrutinising Akshata's investment in these firms.Meanwhile, the opposition in the UK has lashed out at Rishi Sunak, who increased taxes on Britons in the recent budget.Sunak has raised the tax burden on UK taxpayers to its highest level since the 1940s to support the economy amid the pandemic-induced slowdown.A YouGov poll released on Wednesday showed the chancellor's popularity had plummeted to its lowest since assuming his position.The daughter of India's iconic businessman N. R. Narayanmurthy, Akshata married Sunak in 2009. As per British law, any individual is automatically deemed domiciled if they reside in the UK for 15 years.

britain

united kingdom (uk)

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

2022

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

Rishikesh Kumar

https://cdn1.img.sputnikglobe.com/img/07e4/08/04/1080055820_0:0:388:389_100x100_80_0_0_40018ee210946d65d49ffba4f4c008e1.jpg

rishi sunak, britain, infosys, tax evasion, united kingdom (uk)

rishi sunak, britain, infosys, tax evasion, united kingdom (uk)

Rishi Sunak's Wife Appears to Avoid Taxes on Foreign Income in UK Thanks to 'Non-Dom' Status

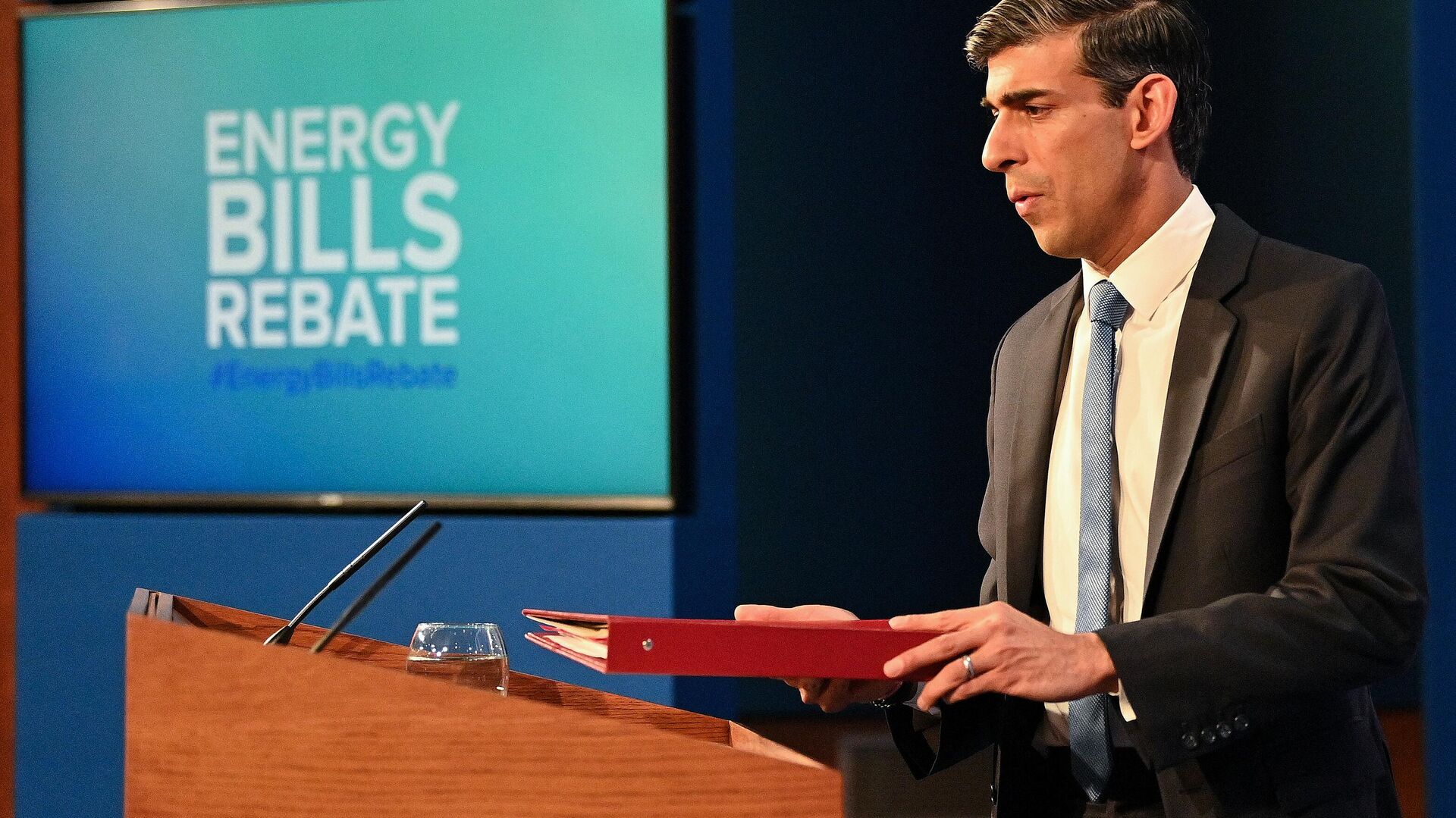

09:04 GMT 07.04.2022 (Updated: 15:18 GMT 28.05.2023) In recent weeks, Rishi Sunak has come under fire over various issues linked to his wife, Akshata Murthy, daughter of Infosys founder N. R. Narayan Murthy. The UK opposition also criticised the finance minister for receiving income from Infosys’ Russia operations.

British Chancellor of the Exchequer Rishi Sunak is facing the wrath of the opposition after it was been revealed that his multi-millionaire wife Akshata Murthy does not pay income tax on foreign earnings due to her non-domicile status.

Akshata Murthy owns a 0.93% stake in the world's fastest-growing tech firm Infosys and received about $15 million as an annual dividend.

UK resident taxpayers pay a 38.1% tax on dividend income.

The "non-dom" status means Murthy legally does not have to pay taxes in the UK on income earned outside Britain.

"Akshata Murthy is a citizen of India, the country of her birth and parents' home. India does not allow its citizens to hold the citizenship of another country simultaneously", Murthy's spokeswoman said in a statement after The Independent reported that Murthy saved millions in taxes due to her non-domicile status.

The statement further added that Murthy "has and will continue to pay UK taxes on all her UK income".

However, there were reports in the past claiming she had routed her investment into firms based in tax haven countries that helped her to evade taxes in India.

The Guardian reported in

November 2020 that Murthy had channelled her money into the restaurant business in India through Mauritius-based IMMAssociates Mauritius—a 100% subsidiary of the UK-based firm International Market Management.

India's Central Board of Direct Taxes (CBDT) has not shared whether it has started scrutinising Akshata's investment in these firms.

"The Income Tax Department does not share details of individual cases", Surabhi Ahloowalia, spokesperson for the CBDT, told Sputnik in response to whether Akshata had paid the right amount of taxes on her income, including earnings from foreign investment.

Meanwhile, the opposition in the UK has lashed out at Rishi Sunak, who increased taxes on Britons in the recent budget.

"The Chancellor has big questions to answer. He must urgently explain how much he has benefited at the same time he was putting taxes up for millions of working families and choosing to leave them £2620 a year worse off", Tulip Siddiq, the shadow economic secretary to the treasury, said.

Sunak has raised the

tax burden on UK taxpayers to its highest level since the 1940s to support the economy amid the pandemic-induced slowdown.

A YouGov poll released on Wednesday showed the chancellor's popularity had plummeted to its lowest since assuming his position.

The daughter of India's iconic businessman N. R. Narayanmurthy, Akshata married Sunak in 2009. As per British law, any individual is automatically deemed domiciled if they reside in the UK for 15 years.